We are excited to announce that our Executive Vice President, Anneke Stender, recently sat down with The Deal’s Chris Nolter to discuss Think Plumb LLC’s remarkable growth and future outlook.

View the full article here: 2025 The Deal Plumb Interview.

Link to article on The Deal website.

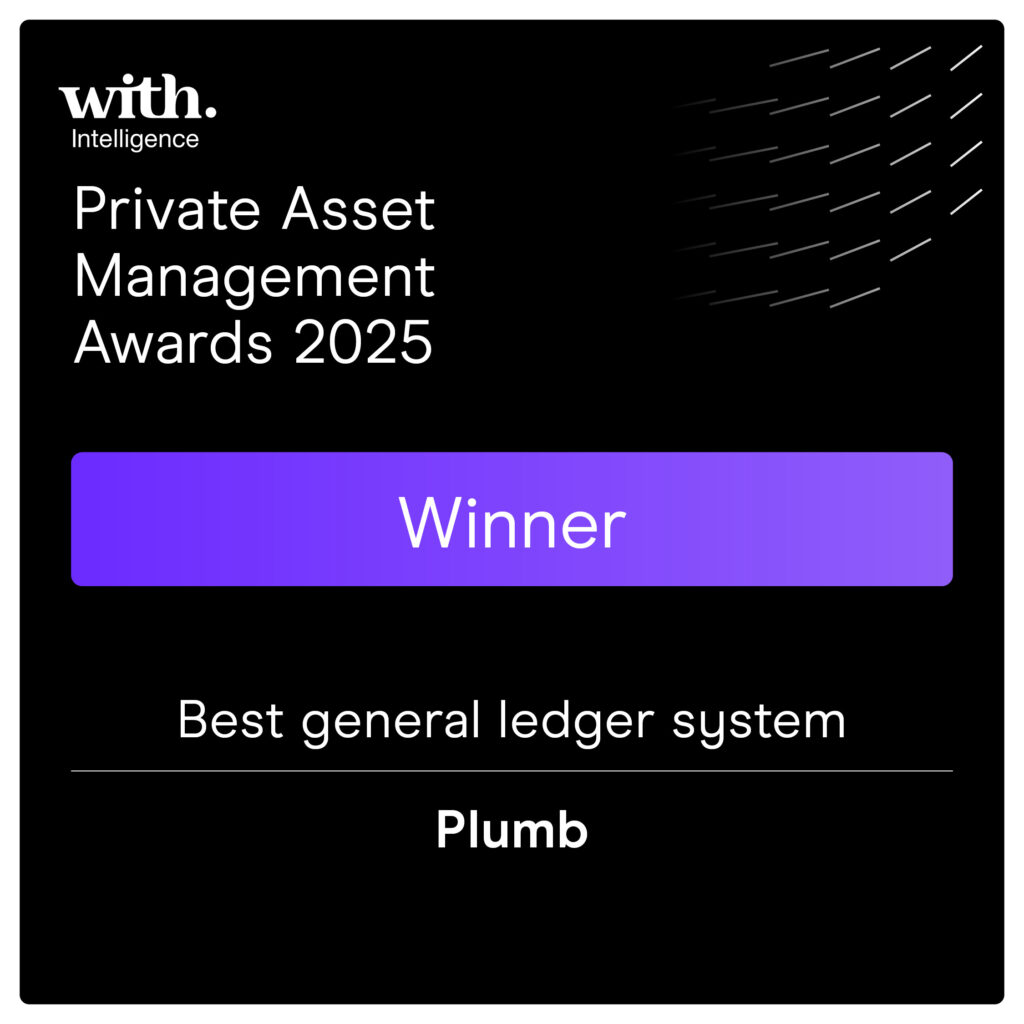

Founded in 1996 by President Robert Scherer, Think Plumb has evolved into a premier high-touch, services-first fintech company specializing in financial management for high-net-worth individuals and family offices. With a workforce of 50 employees and an annual revenue ranging from $8 million to $10 million, Think Plumb continues to experience double-digit growth, positioning itself as a leader in the financial management space.

Managing Financial Complexity with High-Touch Services

Think Plumb is uniquely positioned to help affluent clients manage the complexities of wealth, including multiple residences across different states, trusts, LLCs, foundations, and other entities.

“We call it the blocking and tackling that needs to happen around the family,” Stender explained. “Our clients require specialized accounting services, from property tax management and insurance payments to real-time financial reporting.”

Leveraging Technology for Real-Time Financial Insights

Recognizing the growing need for seamless and intuitive financial management, Think Plumb has invested in building out its proprietary technology platform, the Plumb Bill Pay App. The platform integrates bill approval, payment automation, and real-time reporting capabilities, ensuring clients have an interactive, forward-looking view of their financial health.

“Historically, accounting has been very backwards-looking,” Stender said. “Now, we’re really moving toward real-time reporting, interactive insights, and even projections within our tool.”

A Growth Trajectory with Expanding Market Opportunities

Plumb’s primary clientele typically consists of individuals with a net worth between $50 million and $400 million, including five billionaire family offices. However, the company is looking to expand into a new demographic of emerging high-net-worth individuals—those with a net worth of $1 million or more—who require sophisticated financial tools and bill payment services.

While 90% of new business comes from referrals, Plumb is continuously exploring new opportunities to enhance its reach and impact. With the addition of a Chief Technology Officer last year, the company is advancing its fintech capabilities while maintaining the high-touch, white-glove service that has made it a trusted partner for affluent families.

Open to Strategic Partnerships

As Plumb scales, the company is open to strategic partnerships that align with its vision for innovation and growth.

“We’re certainly open to strategic partnerships as we continue to grow in this space,” Stender noted. However, there is no defined timeline for taking on an investor or partner.

A Unique Approach in Fintech and Financial Management

Plumb stands out in the financial services industry due to its seamless blend of high-touch services and innovative financial technology. The firm’s approach ensures that clients receive both personalized attention and cutting-edge solutions for managing their financial complexity.

The broader fintech and wealth management industry has seen increased investment activity from major financial institutions. Recent investments include:

- Blackstone Inc. (BX) leading a $61 million investment in AI accounts payable automation company Sampli.

- BlackRock Inc.’s (BLK) Aladdin Wealth unit forming a partnership with NEC Corp.’s Avaloq.

- JPMorgan Chase & Co. (JPM) and Hercules Capital Inc. (HTGC) investing $150 million in payables automation company Tipalti.

While investment and acquisition activity in fintech and financial/wealth management continue to accelerate, Plumb remains focused on expanding its services and technology to better serve its clients.

Looking Ahead

As Plumb continues its upward trajectory, the company remains committed to innovation, client service, and growth. By enhancing its proprietary technology, expanding service offerings, and strategically scaling its team, Plumb is well-positioned to meet the evolving needs of high-net-worth individuals and family offices.

Future initiatives include further integrating predictive financial analytics, improving user experience within its platform, and expanding its reach to serve a broader spectrum of clients. With a clear vision for the future, Plumb is dedicated to setting new industry standards and delivering unparalleled financial solutions.

Stay tuned for more updates as we continue to shape the future of high-net-worth financial management.

For inquiries or to learn more about how Plumb can support your financial needs, contact us today!