So – what exactly are Commitments?

Commitments are your recurring bills – whether monthly, quarterly, annually, or some other frequency.

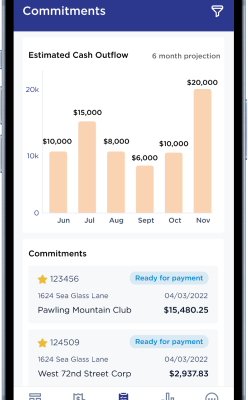

Not only can you – or a trusted advisor – view the projected cash outflow from these recurring bills on the app, but you can drill down to see the details of each bill, including the specific entity, due date, payment status, and amount due.

{For a sneak peak at the Commitments Module of the Plumb Bill Pay App, please watch this brief video.}

Examples of recurring bills are items like property-related expenses:

- Utilities

- Mortgage payments

- Insurance

- Property taxes

- Landscaping

- Maintenance for amenities like pools and tennis courts

- Homeowners’ association (HOA) dues

There are also dependent expenses like tuition, and personal bills like cell phones, credit cards, country club or gym memberships, DMV renewals, updated car registrations, and estimated tax payments — to name a few.

In fact, because we know how important it is for you to see when these bills are due, and to verify that they’ve been paid, you have the option to create your own Hot List.

This personalized selection can be reviewed independently or alongside all your commitments. Bills designated on your “Hot List” are easily identified with a star, ensuring they never slip through the cracks of your financial management.

To learn more about our services and Bill Pay App, please watch this brief overview video and reach out to schedule a personal demo.

Plumb delivers financial peace of mind by assisting high-net-worth individuals and family offices know where their money is going, so their trusted advisors can effectively manage it. We work in partnership with their team — including wealth, CPA, and other advisors — to provide the highest quality of data and financial reporting to establish a holistic view of their assets and financial holdings. We’d love to help answer any questions you may have. Feel free to schedule time to speak with Anneke Stender, our EVP, at your convenience.