Navigating the complex financial landscape of high-net-worth individuals can be like piloting a yacht through dark and uncharted waters.

Their financial complexity arises from a mix of substantial, diverse assets, complex investment strategies, and significant monthly expenses. For these individuals, having a clear and organized view of their income sources and expenditures each month is essential. Without this transparency, making informed and strategic financial decisions becomes exceedingly challenging.

This is where the importance and benefits of digital dashboards come into play.

What are digital dashboards?

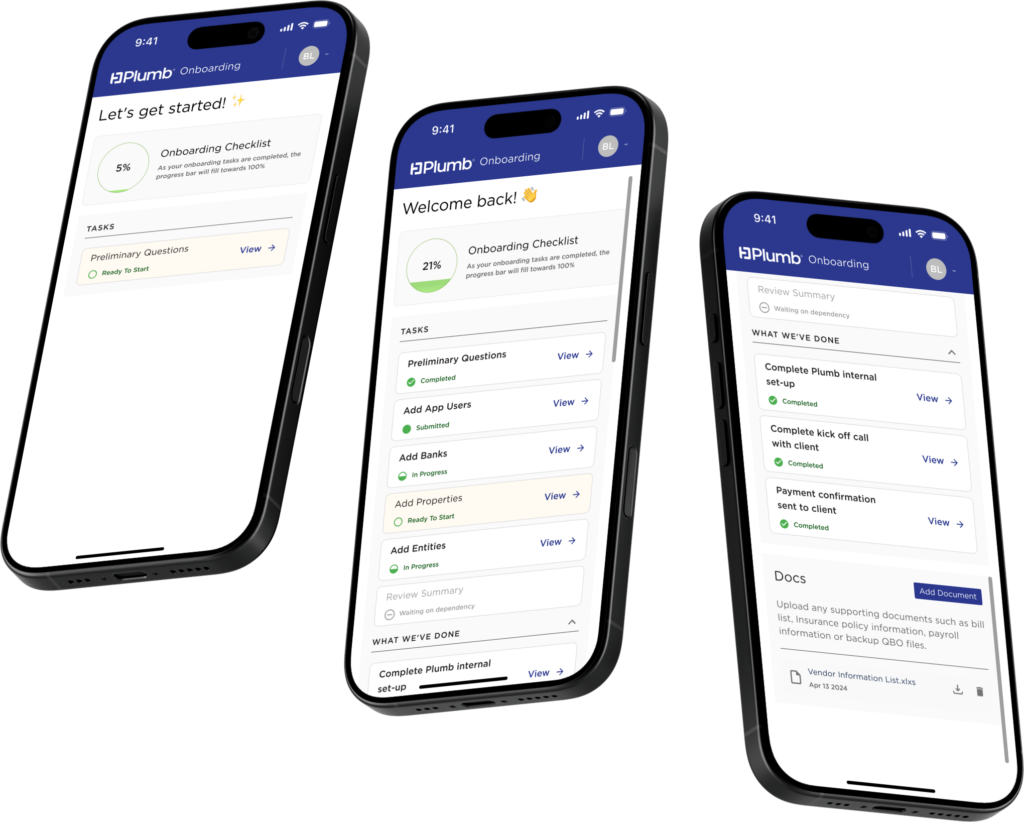

Digital dashboards are a user-friendly way to present data and financial information. They provide high-net-worth clients and their advisors with an uncomplicated way to check their financial performance while offering the option to drill down into the details of specific entities, assets, or expenses – anything that the client or their advisor is interested in seeing in greater detail.

Why use a digital dashboard?

There are many benefits to utilizing digital dashboards – especially for HNWI. We have listed the top five benefits here:

- Clarity: Provides a clear overview of wealth that allows clients and advisors to visualize total assets, liabilities, cash flow, and net worth. (The dashboard on the proprietary Plumb Bill Pay App also provides a balance snapshot and a list of upcoming payment commitments.)

- Convenience: Gives the client and advisor the convenience of real-time updates, removing the concern of looking at data that is already outdated.

- Access: A mobile app, like the Plumb Bill Pay App, delivers access to financials on the go – anytime, anywhere.

- Customization: Offers personalized and customized data and reporting so the client can see precisely what they want and need to see – the information that is most important to them. This customization eliminates the need for clients and advisors to pick through data they do not want or need, and it eliminates the need for them to request additional data that has not been provided.

- Comprehension: Presents financial data in an easy-to-understand layout making the essential information clear and accessible for all levels of financial expertise.

Digital dashboards cut through the complexity of HNWI finances, offering instant clarity and streamlined management. Their visual data formats empower clients and advisors to see the flow of money, make informed decisions, and maximize wealth.

With Plumb you can have access to your bill pay data – anytime, anywhere. Contact us at sales@thinkplumb.com to learn more about our bill pay app and how Plumb can help you and your clients focus on the big picture, while we focus on your bill pay and accounting needs.