Top Ways to Handle Family Life and Business with a Busy Lifestyle

Several responsibilities can cause stress and anxiety in family life and business. It can be hard to find the right balance between organizing family life events and getting year-end ready with clients and other commitments at work.

Here is a list of reminders and quick tips to keep things in perspective in your busy life:

- Schedule: Plan smaller tasks and meetings than normal. Time management is key and keeping a clear overview of due dates on your calendar.

- Disconnect: When spending time with your family, make it a priority to unplug from work emails and calls. Keep everyone informed ahead of time about your unavailability or absence, and let them know when you’ll be reconnecting.

- Plan time for yourself: It can be exhausting to keep everything going, so taking time for yourself will rejuvenate you later.

- Avoid talking business with family or friends when they do not ask. However, it can be helpful to discuss certain topics and events with the most important people in your life to let them know what’s going on.

- Clear communication: Set fixed times for family and work, so both sides can count on you. Be fully present during those time blocks, so you’re focusing on one thing at a time.

- Work when everyone is sleeping: getting up before the family wakes up or staying up after they go to sleep, so it doesn’t conflict with family time.

- Delegate and trust others: bring in additional resources who can help you avoid stress.

An Interview with Anneke Stender

With all your responsibilities at Plumb, how do you deal with upcoming family events and all the organization and planning?

Planning ahead and calendaring everything is essential for me. I plan out the weeks and month very detailed in my corporate calendar, so nothing gets lost and everyone knows if I’m free or not. I always mark events or tasks that are not negotiable in red, so my assistant can plan and schedule meetings around those times.

Overall, the less time I have available, the more efficient I can be. I focus on the really important things and delegate the rest to others. I am thankful to have a great team at Plumb behind me that I count on, so I have enough time for my family.

How do you handle work during the days you are spending time with your family? Are there any rules you set?

When I spend time with my family, I turn off my email notifications. I want to avoid pop-up messages on my phone, so I am fully present to focus that time with my girls and my husband. I dedicate 100% to one thing at a time.

When I visit my family in Germany, I am totally unplugged from work for the duration of the trip. Sometimes I feel that going overseas makes it easier to enjoy the time off, because I am distancing myself from work with different time zones.

Clear communication upfront towards everyone at work and from my family is the key for making this work. By setting fixed times, my availability for family and work is clear, so both sides can count on me.

What is your favorite time and place for getting work done?

My most productive time is early in the morning. I usually wake up at 4:30AM and start checking and responding to emails in bed, then I start getting ready for work. When the children are sleeping, I have time to work without distraction. However, I mostly spend working time in the office in La Jolla or Orange County.

What do you do to avoid stress and how do you boost your energy levels this time of year?

Even if I only have an hour a day, I block it off in my calendar. Pilates helps me to relax from time to time, however, I still struggle on getting better to take time for myself. In addition, it’s always helpful to seek outside help, such as a nanny on special occasions or counting on someone to help with recurring tasks.

As a successful business leader and mother, who inspires you?

Sheryl Sandberg. I just finished reading her second book, “Option B: Facing Adversity, Building Resilience, and Finding Joy. I have so much respect and admiration for her and how she handles her life.

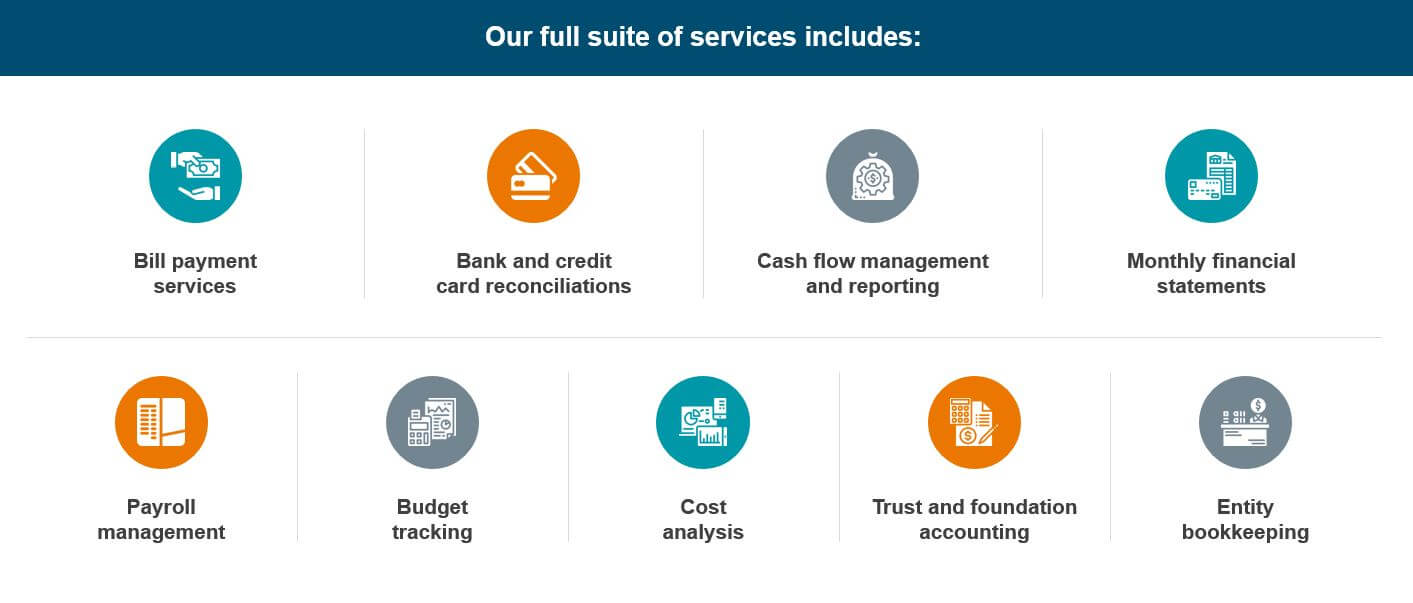

How Plumb Family Office Accounting Can Help with your Family Life + Business Throughout the Year

Recurring tasks like bill payment or handling with taxes at the end of the year, and general organization and planning take an immense amount of valuable time. Save this time and effort with the help from additional resources to spend it with your family and friends or use to refueling your energy.

Plumb Family Office Accounting excels at high-net-worth accounting and financial consulting by applying a controller-level’s financial insight to managing personal finances.

Schedule a Consultation to Learn More:

Related Posts:

- Why Use a Personal Bill Pay Service Firm

- Family Bill Pay Services: Organize your Financial Life

- Five Signs that you Need a Back-Office Family CFO

Find us on

- La Jolla Blue Book

- Expertise – Best Bookkeepers in San Diego

- Rancho Santa Fe Association