- How does your Bill Pay process work?

From initial client set-up to ongoing high-touch support, we have this process down to a science.

- We ask the client or their designee to complete a new client questionnaire.

- Upon receipt of this questionnaire, we prepare a comprehensive solution-oriented proposal.

- Once the proposal is agreed upon and the contract is signed, we begin our seamless Onboarding process. We request a current vendor list and coordinate view only account access, where applicable. We prepare a billing tracker with all of the monthly, quarterly and annual bill pay commitments. Lastly we set-up the client/designee with access to our bill pay app and customize the invoice approval process.

- Once everything is set up, we begin the bill payment work which includes cash flow monitoring and comprehensive reporting. This reporting may include expense tracking, cost analysis/ variance explanations, budgeting, and forecasting.

- At the end of the year, we provide a Year End Summary Report and 1099/1096 filings to ensure that your CPA receives all the necessary details to incorporate the information into the annual tax filings.

If you have any specific questions, read more about our process here.

- How do you keep client confidentiality?

We have full confidence in the established protocols we have implemented to safeguard the confidentiality of our clients.

We proactively protect classified data in several ways:

- We have a customized cloud network built on unique specifications, backed on a singular data center that keeps all data stored and safe from localized data loss. This data center is certified PCI 3.0 compliant, HIPAA compliant, and SSAE-16 Type II compliant.

- We maintain state-of-the-art bank-level security and an in-house IT department that provides constant monitoring and oversight.

- We maintain rigorous oversight of internal client access.

- We focus on a clear segregation of duties among our team.

We pride ourselves on our effective and all-important quality controls, security measures and confidentiality guardianship. Please let us know how we can assist you in your family office accounting or bill pay needs. We have more to share on this topic, so please see our blog posts about how we protect the confidentiality of our clients.

- Do your clients work with a team or an individual?

The quick answer is: both. When you work with Plumb, you have a team of experienced high-net-worth bill payment and accounting professionals at your fingertips. You will be assigned a primary contact for your day-to-day questions and needs, but that person works with an entire team of experts to help ensure not only the necessary quality controls, but also the high-touch support that is synonymous with Plumb.

- Do you pay client bills by check or wire?

We can pay bills by wire, ACH, or checks, and we follow the strictest of protocols to ensure that any and all payments are made securely. Please read our article with more details on this topic, including definitions of some important payment terms, here.

- How does the bank account set up work? Do we set up our own or under their name with a POA?

Bill pay account(s) are set up in the client’s name. The Plumb signers are then added to the account(s) as limited POAs to sign off on banking transactions, such as ACH, wires and checks.

- What type of reporting will they receive and frequency and can we see an example?

This depends on the scope of work. Plumb’s standard reporting package is a monthly expense report with variance analysis.

- Can you help with collecting my K1s at the end of the year?

At Plumb, we can help you track and collect all of the various K-1s you are due to receive each year. As K-1s are received, we reconcile them against the transactions in your books to ensure accuracy and work with the appropriate parties if corrections are needed. We can then provide reconciled year-end financial statements to the CPA for finalizing tax returns. Still have questions? Check out our detailed recommendations here.

- What is your interaction with my CPA?

Plumb works in partnership with CPAs (as well as any other trusted advisors) to ensure all aspects of our client’s financial life work together cohesively, efficiently, and seamlessly. We act as a Controller-level point of contact between the CPA and client by delivering reliable, timely and organized reporting. We track 1099’s, K-1’s, charitable contributions, medical expenses, sales of stock and all other income, and we also handle the preliminary year-end tax work by preparing the Annual Tax Organizer. All this with the goal of being able to provide your CPA with the accurate and updated documentation they require. Read this post about the ways in which we work with other financial advisors.

- Do I have to approve every invoice?

During the onboarding process we will review your goals for the management of your bill payment. We can set up your account so that you can approve certain bills, or bills over a certain amount, or even bills that are a certain percentage higher than what they typically are. Our client services are bespoke, and we can provide the assistance and support that works best for you and your lifestyle.

- What happens with all my bills? Do I forward them or do they come to you and how?

During the onboarding process, Plumb assists in getting delivery emails or physical addresses changed so that all invoices are coming directly to Plumb. During the onboarding/transition time, clients either forward bills to Plumb by email, send them weekly via overnight mail or upload them directly into the Bill Pay App. Generally, after 60-90 the majority of the bills are received directly by Plumb.

- Where is my account manager located and are they in my time zone?

Our Plumb team works remotely in the United States, across a few different time zones. If you prefer to have your main point of contact be someone in your time zone, we will make every effort to find you the best fit. However, we always tell our clients that our Plumb team is just that – a team of experts who are available to help answer questions and provide insights whether you are their direct client or not.

- Do you manage international accounts/handle my home in France? Or just US assets?

We have experience in handling bills related to assets outside of the US. Our recommendation is to be set up as a signer on the foreign bank account for ease of paying the bills oversees.

- Do you have a portal I log into to see the bills?

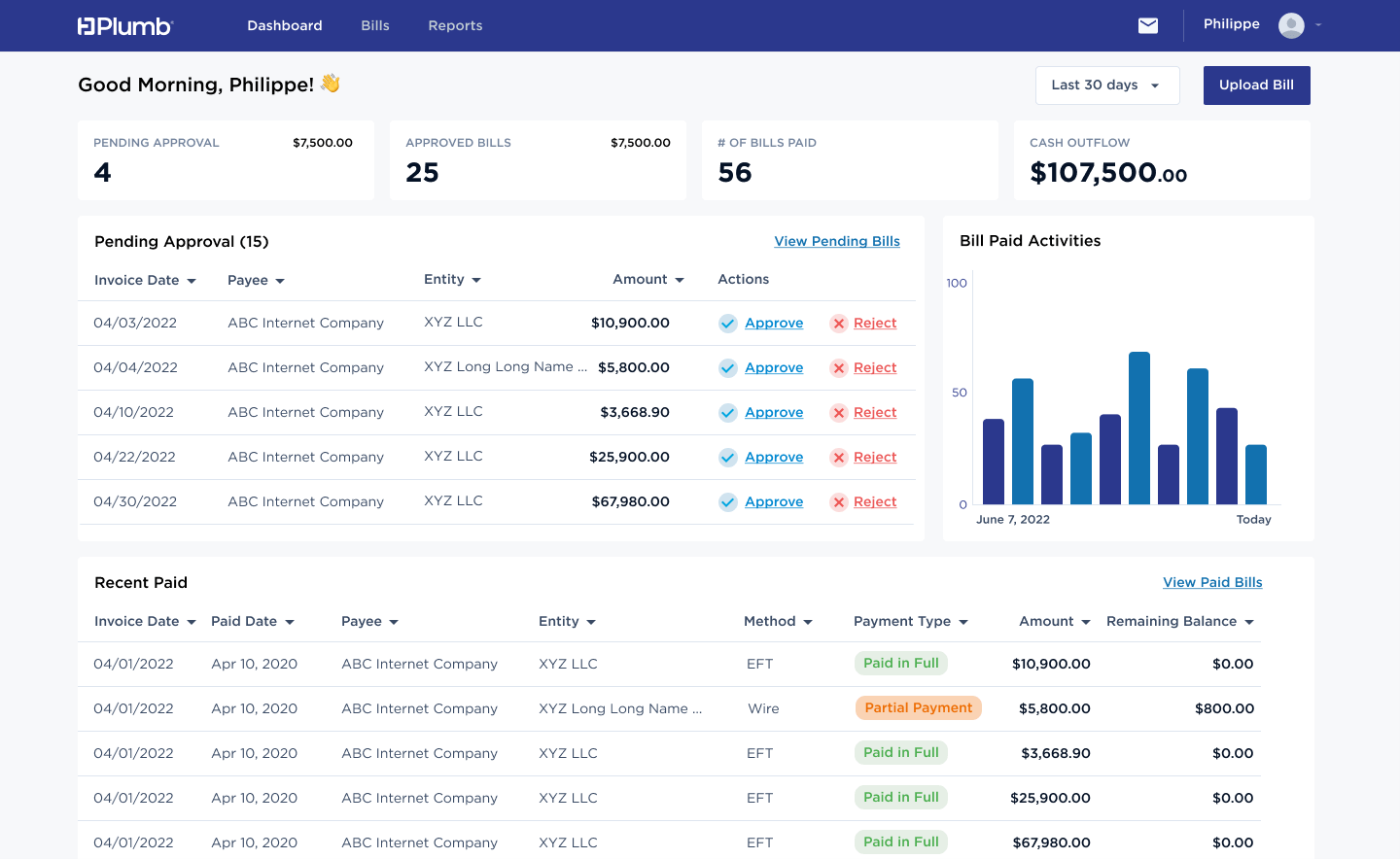

Absolutely. We have a proprietary bill pay app available on both web and mobile devices. Our app was designed with our HNWI clients – and their trusted advisors – in mind. It provides access and clarity to the bill payment process and makes approving bills, viewing bill payment status, and communicating with the Plumb team more accessible and easier than ever. Our intuitive and incredibly useful app is the logical evolution of our high-touch, high-tech service. If you’re interested in a demo, please reach out to Anneke to schedule time.

- Can advisors have view-only access to the information in the software/app?

Yes, that’s not a problem. During client onboarding we will review the details about who should have access to what, and who can issue approvals.

- Can my assistant or property manager approve certain invoices on my behalf?

Yes. You can select any trusted designee to approve certain invoices on your behalf. We can also set up your account so that invoices under or over certain dollar amounts are approved by different people.

- How do I know if more money needs to be funded in the bill pay account and how does that process work?

This can happen in a couple of different ways. The first is that your Plumb team member will let you know if your bank balance is underfunded based on the number and dollar amount of bills in queue to be paid. The second is that our bill pay app will show a bank balance snapshot on the dashboard of available funds. If upcoming obligations exceed the balance, a warning message with the shortfall amount will be displayed.

Plumb Bill Pay & Family Office Accounting is a high-touch technology bill pay and family office accounting service provider dedicated to serving the needs of high-net-worth and ultra-high-net-worth clients. Plumb ensures that your client’s bills are paid on time and works in partnership with you to deliver the highest quality data and financial reporting. In addition to our bill pay services, we also provide comprehensive Family Office Accounting support.

Let’s talk about we can help you, so you can devote more time to enjoying life.