Annual tax preparation for high-net-worth and ultra-high-net-worth individuals can be complicated.

Their intricate financial holdings require not only a significant attention to detail, but a deep understanding of the nuances related to their finances.

In this article, we review some of the key factors at play when these wealthy individuals and their CPAs plan their annual tax filings, and what our role is in this important process.

Income

One of the biggest elements related to tax preparation for high-net-worth individuals is their income. HNWI often have multiple sources of income, including but not limited to:

- Salaries and bonuses

- Dividends

- Rental income

- Capital gains

- Business income

We delve into greater detail on some of these income types below, and they impact annual tax preparation.

Investments

Many high-net-worth individuals have investment portfolios and brokerage accounts. Not only are these types of investments complex to manage and track, but they can also influence the timing of when tax returns can be filed.

Private Equity Investments

These investments play a big role as far as how timely tax returns can be filed. Those who invest heavily in private equity will invariably need to file an extension because K-1’s, which list taxable income related to certain business entities, are often not received until summertime. This late-in-the-year receipt of the document makes it nearly impossible to file taxes on time.

Brokerage Accounts

The number of brokerage accounts dictates the interest and dividend income of the client. It is essential to have the proper process in place to collect this information and be able to tie it out to the tax documents before being submitted to a CPA. We’re proud of the process we have created to ensure that we are able to do this accurately and on time.

Real Estate

Many of our HNW clients own investment or rental properties, and this can be a big tax item. The income and expenses from these properties must be tracked carefully as they are reported differently on tax returns than ordinary income. As new properties are purchased or old properties are sold, it is imperative that these clients retain and provide all documents related to these changes because these documents impact the taxes owed on the gains realized.

For example, escrow statements for real estate purchases need to be sent to the CPA. When a home or property is sold, the cost basis must be documented correctly.

Business Ownership

Another type of income-generating investment that we see with our clients is business ownership. The CPA must understand the ownership structure of the new entity to ensure proper tax filing. When working with clients who own their own businesses, we’ve found managing their personal books and their business books to be a best practice. This allows us to ensure that all net profits and losses are flowing correctly from the business into their personal books. We typically provide the financial information for these entities to the CPAs who in turn roll that into the personal tax returns.

In the event that a client owns a business for which we don’t keep the books, we communicate closely with whomever does so that we have an accurate, updated record of all relevant transactions.

Charitable Contributions

Many affluent individuals make significant charitable donations. Proper documentation and reporting are crucial for these contributions to be deducted appropriately. Any donations made above $250 can be audited, so it is crucial to stay on top of these documents. We collect all charitable receipts from our clients throughout the year. We hold these receipts so we can share a complete and updated charitable contribution receipt file with the CPA to assist them with the tax filing.

Estate and Gift Tax Planning

For both types of tax planning, it’s best to work with experienced professionals. For estate planning, we encourage our clients to seek out the assistance of an estate planning attorney. For gift tax planning, a CPA can help to prepare the returns. Our role in this is to keep track of the transactions when they occur.

Foreign Reporting

For ultra-high-net-worth people with foreign bank accounts, financial assets, or income earned abroad, there is a form that needs to be filed and submitted to the IRS every April. The Foreign Bank Account Reporting form (FBAR) asks for the highest balance in the account at any given point in time for that year, as well as the ending balance at the end of that year. We provide this data to the CPA who then completes the FBAR form and submits the paperwork.

It is important to note that this form is filed separately from the income tax return, and there are no extensions permitted.

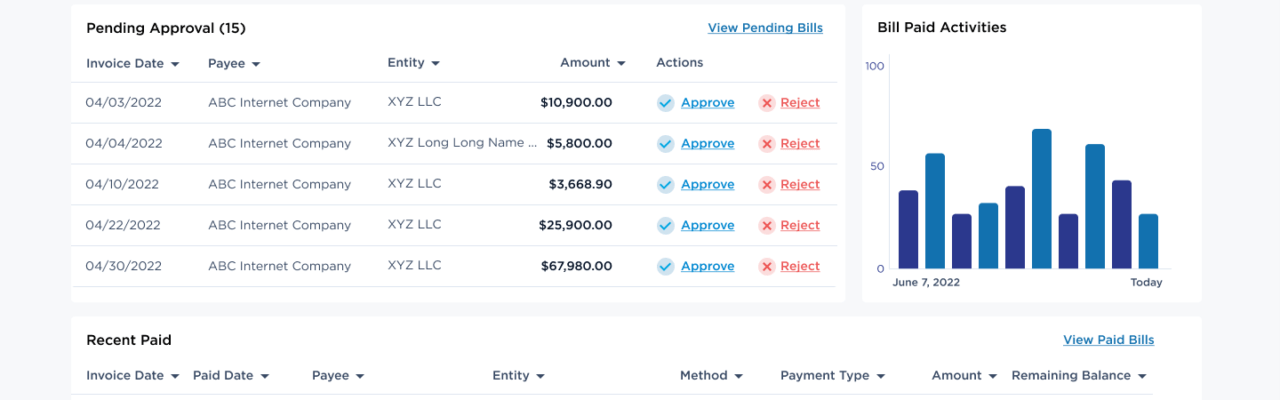

Quarterly Tax Payments

Due to their income level and type of income, high-net-worth individuals often need to make estimated tax payments throughout the year. We provide all necessary year-to-date financials to our clients’ CPA, and once the calculations have been completed by the CPA, we process the tax payments on behalf of our clients.

At the end of the day, helping high-net-worth clients prepare and plan for their annual tax filings comes down to being meticulous with maintenance of their financial documents and records, understanding the complex nature of their unique financial situations, and working with experienced accounting and tax professionals.

Plumb delivers financial peace of mind by assisting high-net-worth individuals and family offices know where their money is going, so their trusted advisors can effectively manage it. We work in partnership with their team — including wealth, CPA, and other advisors — to provide the highest quality of data and financial reporting to establish a holistic view of their assets and financial holdings. We’d love to help answer any questions you may have. Feel free to schedule time to speak with Anneke Stender, our EVP, at your convenience.