Our clients often ask us how we can help them manage capital calls and alternative investments. Our years of experience working with investors and ultra-high-net-worth individuals has allowed us to create best practices for a seamless, secure, and transparent process.

In years past, the timing of capital calls used to be more clearly scheduled and defined, but we have noticed a recent change: capital calls are no longer always scheduled out in advance, but rather they are being made when a fund has the need and/or finds a new investment. This trend results in an even greater need to understand the nuances of a capital call, and to have a clear and safe process in place to address them.

Below we have outlined some of the ways in which we alleviate the administrative burden and stress of capital calls while providing clarity, organization, and security around this pivotal piece of investing.

1. Plumb assists clients with completing Subscription Agreements.

The first step in investing is often the required completion of a Subscription Agreement. These can be lengthy and somewhat tedious forms to complete, but they are a necessary part of investing in a Limited Partnership. We perform this important administrative service for our clients, so they can focus on the big picture. All they need to do is review it and sign.

2. We are proactive in the management of capital calls to ensure our clients are never in breach of contract.

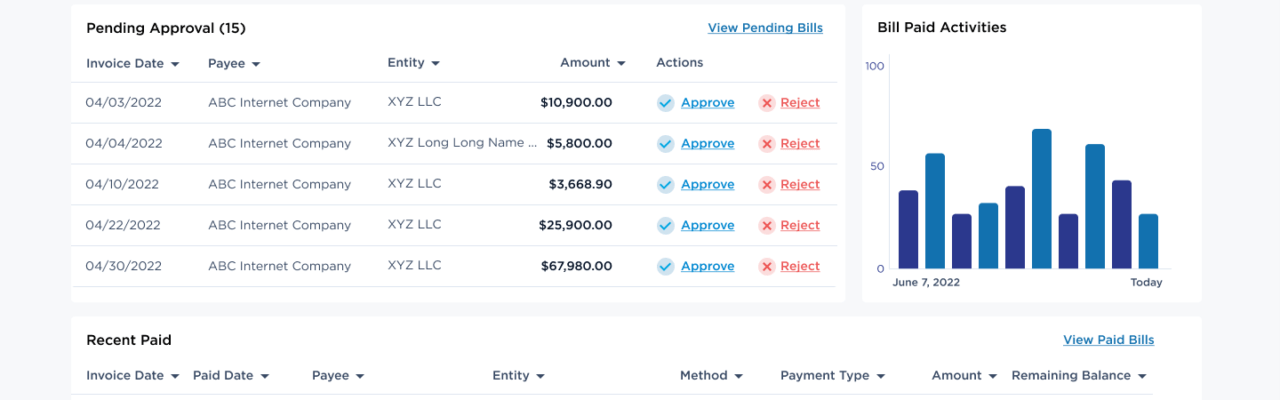

Many of our clients are investors across myriad funds and banks, which can make staying on top of portals, notifications, and deadlines extremely challenging. We create organization around this process. We have access to all the necessary portals so that we can receive and verify all notifications and issue payments on time. Whether our clients’ financial advisors are managing the fund or not, Plumb will track, manage, and issue payments for any and all capital calls.

3. Plumb has a strict and critical wire approval and verification process.

In this age of wire fraud and digital hackers, Plumb has created a best-in-class and hyper-vigilant wire approval and verification process. Our approach gives our clients, their financial advisors, and the funds in which they have invested the peace of mind needed so they can put their focus and energy elsewhere.

4. We provide transparent commitment tracking.

We understand that it can be difficult to track how much money has been paid out and how much might still be owed. We provide our clients with clear and transparent reports that demonstrate precisely how much of their commitments have been met, and what they still will be called upon to pay so they can plan accordingly.

5. Plumb collects, documents, and organizes all necessary K1 forms.

Another critical function of Plumb is to gather and organize the K1 forms for our clients at the end of the year. These forms are often difficult to collect, especially when dealing with varied investments and investment portals. We ensure that all K1 forms are received and shared with the CPAs of our clients in advance of tax season.

At the end of the day, Plumb shines when it comes to managing the administrative and transactional function of capital calls. We are experts in the due diligence and organization necessary to ensure that our clients respond to their capital calls in a timely and secure manner.

Plumb Family Office Accounting delivers financial peace of mind by assisting high-net-worth individuals and family offices know where your money is going, so your trusted advisors can effectively manage it. We work in partnership with your team — including wealth, CPA, and other advisors — to provide the highest quality of data and financial reporting to establish a holistic view of your assets and financial holdings. This gives you true control of your wealth and establishes the foundation for effectively implementing your financial strategies. Please let us know how we can help you or your clients. We’d love to hear from you.