There are people who invest in stocks, bonds, mutual funds or real estate; and then there are people who invest in more unique assets. These assets can range from photographs and paintings to jewelry and classic cars. More often than not, this is born out of a true love for these items. That they may hold extraordinarily high values is just the cherry on top.

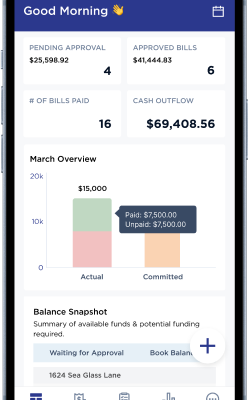

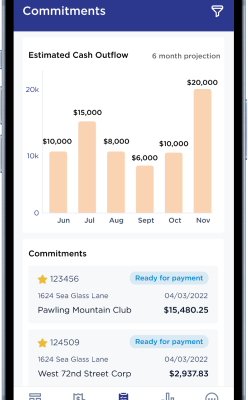

With Plumb’s decades of experience helping high-net-worth clients and their trusted advisors with their bill pay and accounting needs, we are very familiar with the best practices of the reporting and accounting requirements related to these special assets.

Here are some of the ways we work with clients and their luxury assets:

Art and Car Collections

- It is recommended that clients that have art or classic car collections should itemize every piece or vehicle in the collection.

- These items may also be held in separate entities – especially if clients do a lot of buying and selling. We may recommend the use of Sage Intacct to make use of their dimensions for ease of tracking. Otherwise, we can utilize subaccounts in QuickBooks.

- If a client loans a piece or a collection to a museum, a loan agreement is needed, and we will help coordinate with the insurance company. The museum is responsible for the insurance of the piece(s) while it’s in their possession, and when returned, the insurance again needs to be updated.

- If an appraisal is conducted, we will coordinate with the appraiser to receive the report on both the inventory and assigned values.

Jewelry

- Jewelry is not always itemized since most clients have a rider on their home policy up to a certain amount that can cover this type of asset. However, we recommend itemizing if clients have more valuable jewels or watches.

- As with art or car collections, if the client requests an appraisal, we’ll receive the report directly from the appraiser.

At the end of the day, our goal is to accurately itemize these unique, luxury assets for insurance purposes, and they are tracked separately for accounting reasons. And our clients usually just want to ensure that they – and their children and grandchildren – can enjoy these magnificent possessions for a long time to come.

Take the Next Step Towards Financial Ease and Clarity: Contact us at sales@thinkplumb.com to discuss how our outsourced bill payment and accounting services can help you accurately itemize and report on your luxury assets. Your peace of mind is our priority.